Understanding the 2025 Credit Score Chart: A Comprehensive Guide

Introduction to Credit Scores

Credit scores are numerical representations of an individual’s creditworthiness. They play a crucial role in personal finance, affecting not only loan approvals but also the terms and interest rates attached to financial products. Essentially, a credit score serves as an indicator of the reliability of a borrower, helping lenders assess the likelihood of timely repayment. Various scoring models exist, with the most widely recognized being the FICO score and the VantageScore, both of which use distinct algorithms to evaluate an individual’s credit history.

The significance of credit scores cannot be overstated. A higher score is often associated with better financial opportunities, including lower interest rates on mortgages and car loans, which can result in substantial savings over time. Conversely, individuals with lower scores may face challenges in securing loans or may be subject to higher rates, increasing the overall cost of borrowing. Consequently, maintaining a good credit score is essential for financial health and stability.

Several factors influence credit scores, including payment history, credit utilization, length of credit history, types of credit in use, and recent credit inquiries. Payment history, which reflects whether bills are paid on time, contributes significantly to the score, while credit utilization compares the amount of credit currently being used against the total available credit and ideally should remain below 30%. Additionally, the duration of credit accounts and the diversity of credit types can either bolster or diminish a credit score.

Understanding these components is vital for individuals seeking to improve or maintain their credit scores. With the right awareness and management strategies, it is possible to enhance one’s credit profile, ultimately leading to better financial prospects.

A Look at the 2025 Credit Score Chart

The 2025 Credit Score Chart is an essential tool for individuals seeking to evaluate their financial health and understand their standing in the credit landscape. Credit scores typically range from 300 to 850, with different categories that classify these scores into various groups such as excellent, good, fair, and poor. In 2025, the ranges have solidified into widely recognized thresholds that aid consumers in assessing their creditworthiness. An excellent credit score falls between 750 and 850, denoting a strong ability to repay debt and qualify for the best interest rates. Good scores, ranging from 700 to 749, showcase a solid credit history but may slightly impact loan terms. The fair category, ranging from 650 to 699, indicates a more cautious approach to borrowing, while poor scores, below 650, reflect significant obstacles in obtaining credit.

Over the years, these credit score ranges have been subject to adjustments influenced by economic conditions and consumer behavior. With the development of new scoring models and data sources, a more precise understanding of an individual’s creditworthiness has emerged. For example, the introduction of alternative data points—such as payment history for utilities and rental agreements—has reshaped how scores are calculated, affecting historic range thresholds. These changes have not only benefited consumers who might be traditionally underrepresented in credit scoring but have also shifted the dynamics in lending practices.

As consumers familiarize themselves with the anticipated changes represented in the 2025 Credit Score Chart, it becomes crucial for them to monitor their financial behavior. Understanding where one’s score lands within these ranges is vital for making well-informed decisions regarding loans, credit cards, and overall financial planning. By recognizing their current credit standing, individuals can work toward improving their scores and leveraging better financial opportunities.

Factors Impacting Your Credit Score in 2025

Understanding the factors that influence your credit score is essential for maintaining a healthy financial profile. In 2025, several key components play a significant role in determining creditworthiness. The most critical factor remains payment history, which accounts for approximately 35% of your credit score. This metric reflects your consistency in repaying debts on time. A history of missed or late payments can severely impact your credit score, making timely payments crucial.

Another important factor is credit utilization, representing about 30% of your credit score. This metric measures the ratio of your outstanding credit card balances to your total available credit. Ideally, keeping your credit utilization below 30% will positively influence your credit score. Observing this guideline not only demonstrates responsible credit management but also mitigates risks associated with overspending.

The length of your credit history constitutes 15% of your overall score. This factor emphasizes the importance of maintaining older credit accounts, as long-standing accounts offer lenders insights into your financial behavior over time. Opening new credit accounts may be tempting, but potential borrowers should also consider the impact that newly opened accounts might have on their average account age.

New credit inquiries account for 10% of your score. When you apply for new credit, lenders perform a hard inquiry, which can temporarily impact your score. It is advisable to limit applications for new credit to avoid negatively affecting your credit health. Lastly, types of credit in use make up 10% of your score, reflecting various accounts such as credit cards, mortgages, and installment loans. A diverse mix of credit types can portray you as a more reliable borrower.

By understanding these crucial components and strategically managing them, individuals can effectively optimize their credit scores in 2025 and beyond.

How to Check Your Credit Score

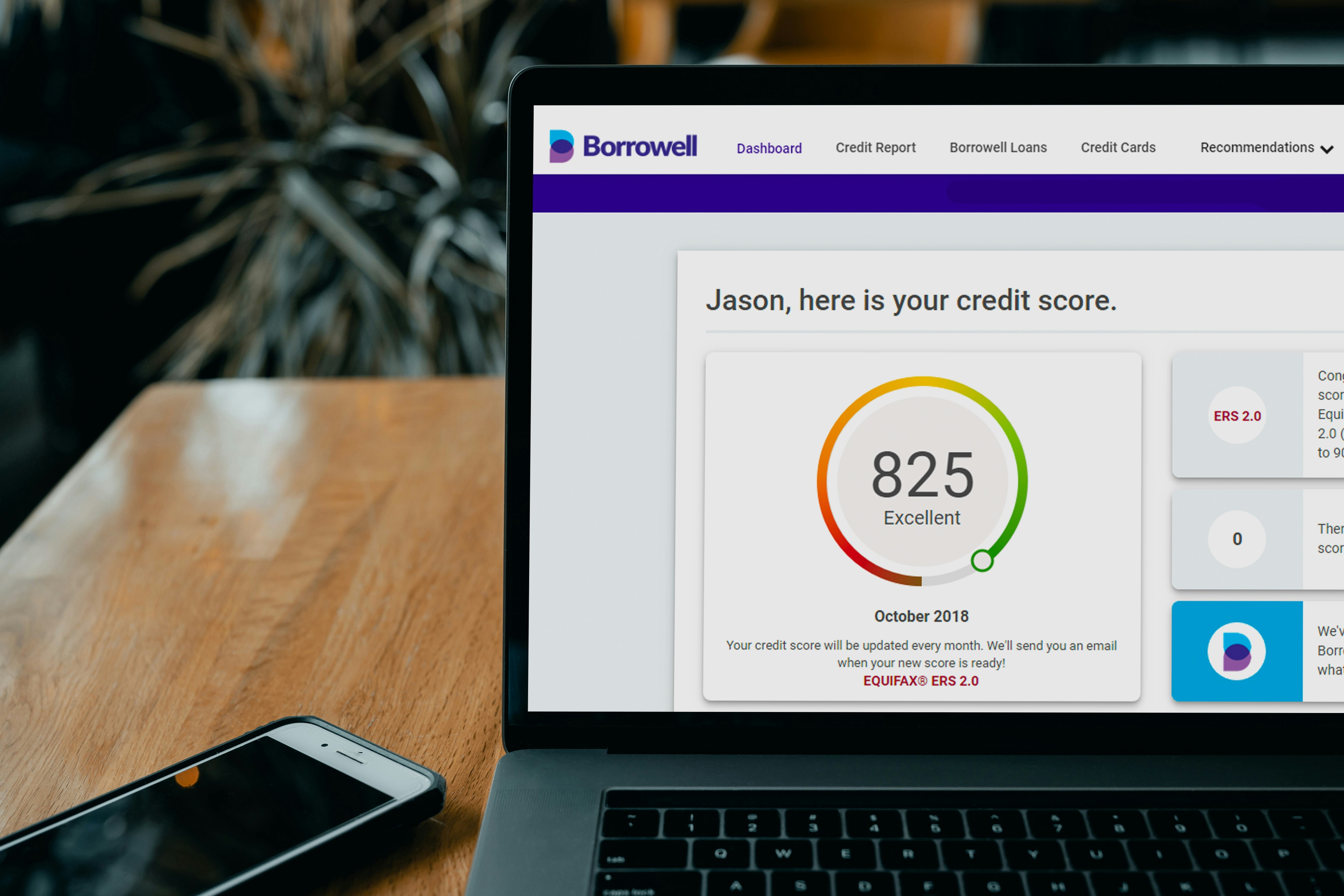

Monitoring your credit score is a crucial part of financial health. Individuals can check their credit scores for free through several credit reporting agencies, including Equifax, Experian, and TransUnion. These agencies provide online platforms where consumers can access their credit reports, often at no cost, once a year. It’s wise to take advantage of this feature, as it allows individuals to verify the accuracy of their credit report and address any discrepancies that could affect their overall credit score.

Understanding the importance of regularly checking your credit score cannot be overstated. By routinely monitoring, you can gain insights into how your financial behavior impacts your score. This awareness helps manage debt effectively and can enhance your chances of securing loans or favorable interest rates. Furthermore, being proactive about your credit score enables you to detect signs of identity theft early and take appropriate action.

When checking your credit score, it’s essential to differentiate between hard and soft inquiries. A soft inquiry, such as checking your own credit score, does not impact your credit rating. Conversely, a hard inquiry occurs when a lender reviews your credit report as part of their decision-making process for a loan application, which may temporarily reduce your score. Understanding this distinction is crucial, especially for those planning to apply for major loans or credit soon.

In conclusion, regularly checking your credit score through reputable credit reporting agencies is vital. Not only does it help you maintain an accurate financial profile, but it also supports you in making informed decisions regarding your credit and overall financial health. Prioritize this practice to ensure you are well-informed and prepared for future financial opportunities.

Improving Your Credit Score in 2025

As we navigate the evolving financial landscape of 2025, understanding how to enhance your credit score is crucial. A strong credit score not only increases your chances of loan approval but can also lead to lower interest rates, ultimately saving you money. Implementing strategic measures to improve your credit score has never been more important.

One of the most effective strategies is ensuring that you pay your bills on time. Payment history accounts for a significant portion of your credit score, and late payments can have a detrimental effect. Setting up automatic payments or reminders can help mitigate the risk of missed deadlines. Additionally, consistently paying off credit card balances rather than allowing them to accumulate can reduce your outstanding debts, which directly influences your credit utilization ratio. Keeping this ratio below 30% is generally advisable to maintain a healthy score.

Another critical step in enhancing your credit score involves reviewing your credit reports for inaccuracies. Mistakes can occur, often due to clerical errors or outdated information. If you find any discrepancies, disputing these inaccuracies with the credit bureaus can lead to timely resolutions, thus positively impacting your credit score. Monitoring your credit report regularly enables you to stay informed about your financial standing and rectify any errors promptly.

Finally, building a positive credit history is essential for maintaining a good credit score. This can be achieved by responsibly using various types of credit, such as installment loans, credit cards, and retail accounts. Over time, a diverse credit mix can reflect positively on your credit profile. Proactively managing your credit, particularly under the updated standards of 2025, is essential for achieving long-term financial health.

Common Myths About Credit Scores

Credit scores play a crucial role in personal finance, yet numerous misconceptions surrounding them can lead to significant misunderstandings. One prevalent myth is the belief that checking your own credit score adversely affects it. In reality, when you check your own score, it is classified as a “soft inquiry.” Soft inquiries do not impact your credit score, whereas “hard inquiries,” such as those made by lenders when you apply for a loan, can have a minimal effect. Therefore, it is essential to regularly monitor your credit score to stay informed about your financial health without worrying about damaging your score.

Another common myth pertains to credit card balances. Many individuals assume that maintaining a balance on their credit cards is necessary to improve their credit scores. However, this is not the case. Carrying a balance can lead to unnecessary interest charges and does not inherently enhance your credit score. In fact, credit utilization, which is the ratio of your credit card balances to their limits, is a critical factor in determining your score. Keeping your utilization below 30% is generally recommended for a healthy credit score.

Furthermore, some believe that closing old credit accounts will positively impact their credit scores. In truth, closing an account can reduce your overall credit history length and increase your credit utilization ratio, which can negatively affect your score. Maintaining well-managed, older credit accounts can contribute positively to your credit history, showcasing your experience as a borrower.

By debunking these myths, individuals can make informed choices about managing their credit scores. Understanding the fundamentals surrounding credit scores helps build a strong financial future and empowers individuals to navigate their financial responsibilities effectively.

Credit Score Tools and Resources

As consumers increasingly recognize the importance of maintaining an optimal credit score, various tools and resources have emerged to assist them in tracking and managing their financial health. Numerous websites and mobile applications now offer easy access to credit score monitoring, allowing users to stay informed about their credit standing in real-time. These platforms typically provide features such as alerts for significant changes to the credit report, tips for improvement, and personalized insights tailored to individual credit profiles.

Among the notable tools are services like Credit Karma and Experian, which offer free access to credit scores and detailed analysis of credit reports. Users can benefit from interactive features that explain credit scoring models, helping them understand the factors impacting their scores. Additionally, many of these services promote financial literacy by providing educational articles and resources related to credit management, debt reduction, and responsible borrowing practices.

For those seeking a more structured learning approach, several online courses and webinars have been developed to enhance credit literacy. Programs offered by organizations such as the National Foundation for Credit Counseling (NFCC) focus on teaching individuals how to build a strong credit history, identify potential pitfalls, and develop effective strategies for credit repair. Participants in these educational sessions gain not only a better understanding of credit scores but also the confidence to make informed financial decisions.

Moreover, financial institutions are increasingly recognizing the need for credit education among their customers. Many banks and credit unions provide online tools and resources, alongside dedicated financial advisors, to guide consumers toward improving their credit profiles. This comprehensive landscape of tools, applications, and educational materials empowers individuals to take charge of their credit scores, ultimately fostering a more financially literate society.

The Future of Credit Scoring

The landscape of credit scoring is poised for significant evolution beyond 2025, driven by advancements in technology and shifts in consumer behavior. As financial institutions increasingly rely on data-driven decision-making, the traditional credit scoring models may undergo profound transformations. These changes will likely incorporate a wider variety of data points, effectively allowing for a more holistic assessment of an individual’s creditworthiness.

One potential trend is the integration of alternative data sources in credit assessments. This could include factors such as utility payment histories, rent payments, and even subscriptions to various services. By analyzing these additional data points, lenders can gain deeper insights into a consumer’s financial habits, thereby mitigating the risks associated with lending to individuals who may have thin or non-existent credit histories. As a result, access to credit may become more inclusive, particularly for underserved populations.

The advent of artificial intelligence (AI) and machine learning technologies is also expected to reshape credit scoring processes. These technologies can analyze vast amounts of data in real-time, providing lenders with instant assessments of creditworthiness. This data-driven approach can foster a more personalized borrowing experience, with tailored loan options and interest rates based on individual circumstances. Additionally, ongoing monitoring of borrowers’ financial behaviors may lead to dynamic scoring models that adjust periodically, rather than rely solely on historical data.

However, the shift towards more advanced credit scoring methods raises important questions regarding privacy and data security. Consumers will need to be informed about how their data is being used and protected. Transparency in these new systems will be crucial for maintaining trust between consumers and financial institutions in the evolving credit landscape.

As these trends unfold, consumers should remain vigilant and proactive in managing their credit profiles. Understanding the emerging credit score models and the influence of technology will position individuals to navigate the changing financial terrain effectively.

Conclusion: The Importance of Staying Informed

In today’s financial landscape, understanding credit scores is more critical than ever. The 2025 Credit Score Chart serves as a valuable tool, allowing individuals to navigate the complexities of credit evaluation effectively. A solid comprehension of credit scoring factors, such as payment history, credit utilization, and length of credit history, can significantly impact one’s financial opportunities, including loan approvals, interest rates, and housing options.

Staying informed about changes in credit scoring criteria is crucial. The financial world is continuously evolving, with regulatory adjustments and innovative lending practices shaping how credit scores are determined. For instance, new models may place different emphasis on certain factors, which could affect how your score is calculated. Therefore, it is advisable to regularly monitor your credit reports and scores, as this practice not only enhances your understanding but also enables you to detect any discrepancies that could harm your financial standing.

Moreover, taking proactive measures towards credit management is essential for maintaining a healthy financial profile. Strategies such as timely bill payments, reducing debt load, and effectively managing credit card balances play a significant role in shaping one’s credit score. By adopting responsible financial behaviors, individuals can enhance their creditworthiness over time, leading to favorable financial conditions and better borrowing prospects.

Ultimately, understanding and actively managing credit scores is an ongoing process that requires diligence and awareness. As we look toward the future, arming ourselves with knowledge about credit scoring can empower us to make informed financial decisions, paving the way for stability and growth. Therefore, prioritize becoming knowledgeable about your credit score and take deliberate actions to foster a robust financial health.